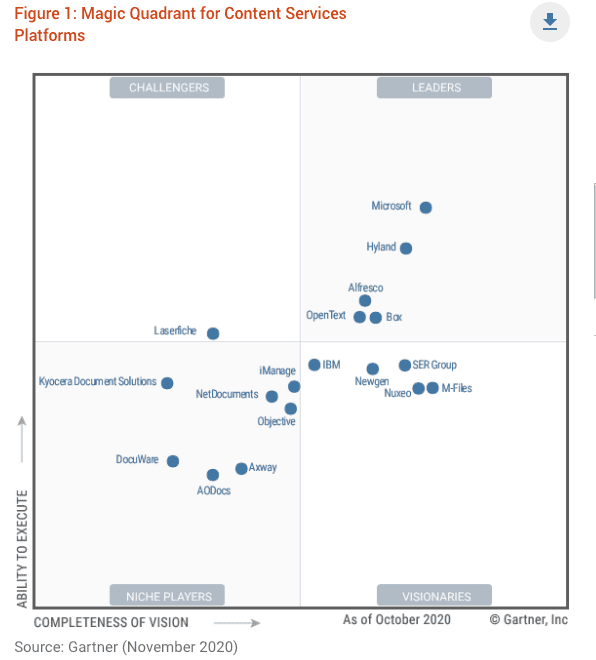

Every year Gartner does a complete review of the content services platform marketplace. This year brought some interesting excitement – along with vendor re-alignment. InfoDNA Solutions has seen this shift taking place in our engagement with clients and now it is confirmed by Gartner.

Obtain the complete report HERE

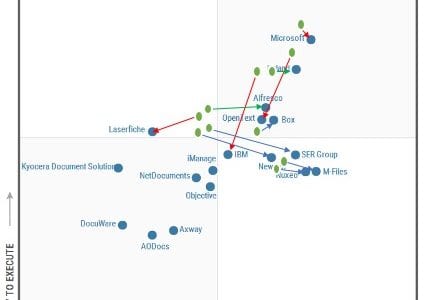

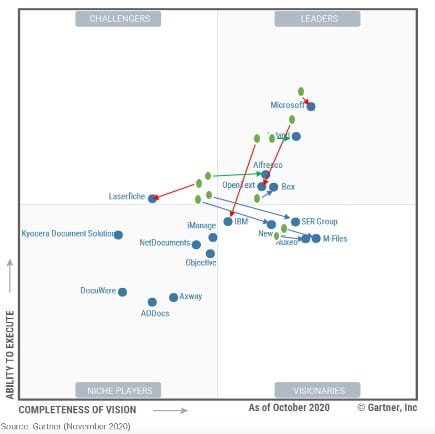

What makes this year especially interesting is the significant drop of IBM and OpenText in both corporate vision and execution. But they are also not the only casualty of a lack of focus and investment. Below is a comparative view from 2019 to 2020 for those outside of ‘Niche’.

The desire to get off of (1) complex, expensive and not customer-friendly and move to (2) nimble, easier to use and more customer aligned in their contracting and expectations. That is the new normal.

The desire to get off of (1) complex, expensive and not customer-friendly and move to (2) nimble, easier to use and more customer aligned in their contracting and expectations. That is the new normal.

Consider what Gartner states about IBM and OpenText as a ‘Caution’:

IBM

- Declining market share: According to Gartner’s analysis, IBM is one of two vendors in the content services market share analysis with a declining market share

- Lack of content services sales support: Gartner hears regular and consistent feedback from IBM content services clients that they are frustrated with the level of account management and sales support offered to assist their initiatives

- Diluted content services marketing vision: IBM’s marketing vision obscures the role of content services within messaging around broad “digital” objectives, rather than clarifying it

OpenText

- Customer experience: OpenText is the subject of more inquiries from Gartner clients about license audits than any other CSP vendor.

- Varied content intelligence effectiveness: Application leaders should work with OpenText to identify reference clients for Magellan and to set up POCs to test the tool against their specific use cases.

- Complex implementations: Content services projects are complex, but Gartner clients regularly cite OpenText for adding additional difficulty.

InfoDNA consider these table-stakes in what a client should expect from a market leader. For that reason, the Topla product was created to help clients reconcile their mix of legacy technologies PLUS all those network drives and lesser storage options. To treat them all as a single virtual ‘collection’ and accelerate the move to a vendor that is showing the right direction in the analyst community.

Learn more at www.infodnasolutions.com.