Opentext is known for their ‘growth by acquiring’ strategy. The number of repositories they sell now is enormous – OpenText Content Services (mainly for SAP installs), Documentum (from their EMC ECD acquisition), Application Xtender (also from the EMC ECD acquisition), eDocs, InfoArchive, Artesia (for digital asset management), eMotion, Mediabin – the document management software list goes on and on.

Through it all – this perpetually licensed software has shown less and less relevance in the enterprise content management markets they represent. Consider three facts – Gartner’s Peer Insights Reviews, the Gartner’s latest Magic Quadrant chart on Content Services and the OpenText financials themselves.

Through it all – this perpetually licensed software has shown less and less relevance in the enterprise content management markets they represent. Consider three facts – Gartner’s Peer Insights Reviews, the Gartner’s latest Magic Quadrant chart on Content Services and the OpenText financials themselves.

Gartner Peer Insights Reviews

This is a place where end-users post their opinions within the Gartner environment of vendors and products. It also allows anyone to look at an obfuscation of the data and can filter by time and organization size. For being such a ‘leader’ the OpenText results from this perspective looks below par – especially compared to other players like Microsoft, BOX and others. If you drill into the data by geo or company size, it becomes even more revealing. Read more here: https://www.gartner.com/reviews/market/content-services-platforms

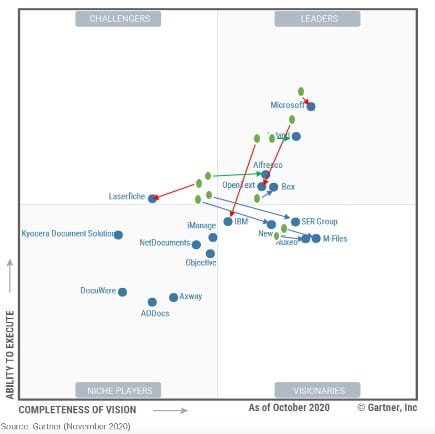

Gartner’s Magic Quadrant chart on Content Services

Gartner offers an annual review of software markets including the ‘Content Services’ market – which OpenText is rooted. The more UP and TO THE RIGHT an organization, the more they lead an overall market. Where this is especially revealing is when you map over time the trajectory of an organization. Using the 2019 and 2020 mapped over each other you see how OpenText took a big negative drop DOWN and TO THE LEFT as per the drawing to the right. From our previous BLOG on this topic, Gartner also outlined three ‘cautions’ that outline a company in distress:

- Customer experience: OpenText is the subject of more inquiries from Gartner clients about license audits than any other CSP vendor.

- Varied content intelligence effectiveness: Application leaders should work with OpenText to identify reference clients for Magellan and to set up POCs to test the tool against their specific use cases.

- Complex implementations: Content services projects are complex, but Gartner clients regularly cite OpenText for adding additional difficulty.

A company who has such a large number of inquiries into Gartner relating to ‘software audits’ that is a sign of a company grasping to drive up short term revenues.

OpenText financials

February 4, 2021 OpenText announced earnings that showed a strategic desire to strive for ‘Annual Recurring Revenues’ (ARR)and ‘Strong Operational Excellence’ (which is code for spending less money). What is especially visualable in the numbers is the revenue line item called ‘license‘ that had a year-over-year drop of (22.5%). This is representation of all this previously acquired software and the lack of clients adding to their ‘perpetual licensed’ software. All the while OpenText is trying to get clients to move their workloads to the ‘OT Cloud’ which also shifts them from this license model to ARR – but that has been generally unsuccessful.

MORALE TO THE STORY

MORALE TO THE STORY

A reduced investment in R/D (because revenues are down), software audits disenfranchising clients, Gartner’s drop of them in the relevance in the charts and their overall low score on Glassdoor (which is a reflection of the employees of the company) show a future of low innovation and competitors win the next workloads.

Contact InfoDNA who brings the ability to help clients clean up what they have in the way of content, reconcile across platforms what is worth keeping and recommending and implementing a next future from a technology, process and best practice perspective.