In all the ways the content services vendor innovations seems stagnant, there is a lot of movement from a capitalization and money perspective.

With that, InfoDNA wants to offer up some predictions for 2021 based on public news, what customers are telling us and a review of executive shifts in the marketplace:

With that, InfoDNA wants to offer up some predictions for 2021 based on public news, what customers are telling us and a review of executive shifts in the marketplace:

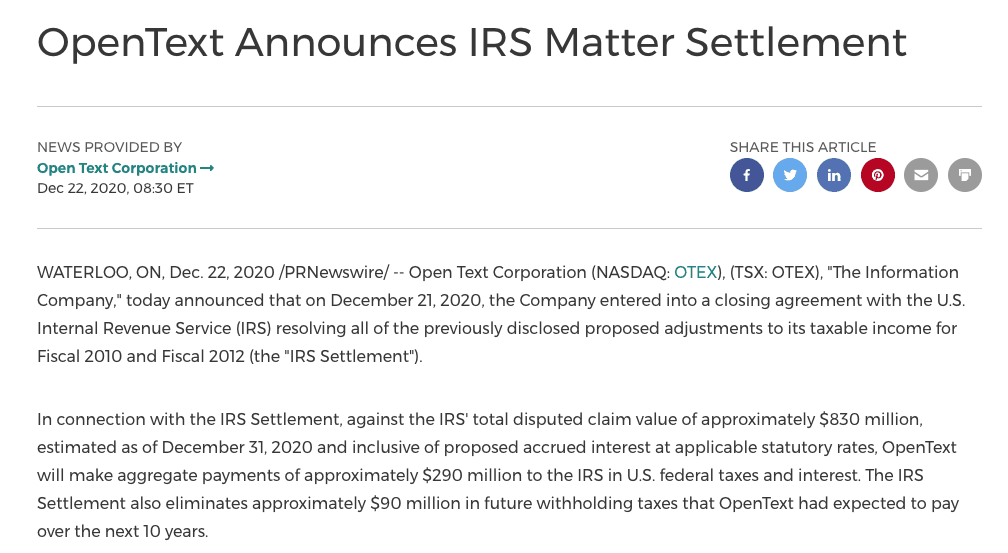

OpenText – No one would ever consider OpenText an ‘innovator’. They are an acquiring of ‘market opportunities’ and driven to grow through acquisition, increasing maintenance and auditing customers to make short-term monies. Add to this prediction the fact that their head of cloud – Savinay Berry – is no longer at the company. Financially they are weighted down by an enormous amount of debt, just settled a tax liability with the US government worth $290 million and increased their stock dividend and stock buyback. Score: NEGATIVE

IBM – Gartner summed it up on the Magic Quadrant with (1)Declining market share, (2) Lack of vision and (3) Lack of focus. The non-existence of a goto-market effort and other lacks of investments into a partner ecosystem, employees and selling effort make InfoDNA believe this will be one of the technologies IBM divests next. Score: VERY NEGATIVE

IBM – Gartner summed it up on the Magic Quadrant with (1)Declining market share, (2) Lack of vision and (3) Lack of focus. The non-existence of a goto-market effort and other lacks of investments into a partner ecosystem, employees and selling effort make InfoDNA believe this will be one of the technologies IBM divests next. Score: VERY NEGATIVE

Microsoft – Their continued investment in SharePoint and bringing new incremental technologies to add cloud-based capabilities around automation, analysis and workflow are showing that even elephants like Microsoft can be nimble. They have brought out in the last near Viva, Syntex and show more is coming. Add to this if a client is a 365 client, how much they have access too now at no cost. Score: VERY POSITIVE

BOX – As previously discussed in our BOX BLOG, Box is for sale. But this is not happening from a place of optimism, but pessimism. They have made significant missteps, lack in properly resourcing the right efforts, losing executives and have a hedge fund now taking them to task. All the while, they are driving better profits by not spending money. Score: NEGATIVE

BOX – As previously discussed in our BOX BLOG, Box is for sale. But this is not happening from a place of optimism, but pessimism. They have made significant missteps, lack in properly resourcing the right efforts, losing executives and have a hedge fund now taking them to task. All the while, they are driving better profits by not spending money. Score: NEGATIVE

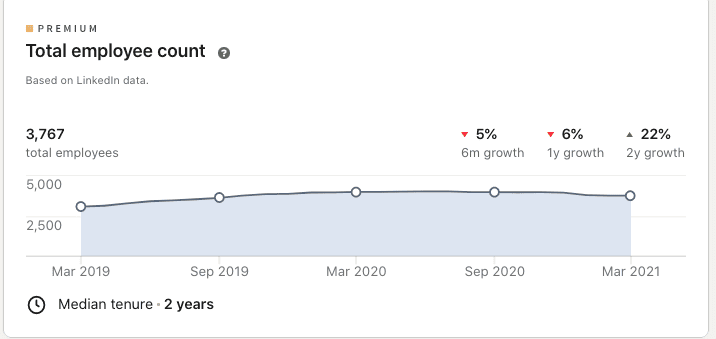

Dropbox – They deem to not want to be looked as a ‘content’ player based on the Gartner report, but they have also just laid off a lot of people and what they do have has not been in the payroll a long time (2 years). While born-in-cloud firms has been flourishing during COVID, Dropbox has been challenged. They recently separated from their COO, CMO and other top-tier management leaders showing a lot of chaos. Score: NEGATIVE

Dropbox – They deem to not want to be looked as a ‘content’ player based on the Gartner report, but they have also just laid off a lot of people and what they do have has not been in the payroll a long time (2 years). While born-in-cloud firms has been flourishing during COVID, Dropbox has been challenged. They recently separated from their COO, CMO and other top-tier management leaders showing a lot of chaos. Score: NEGATIVE

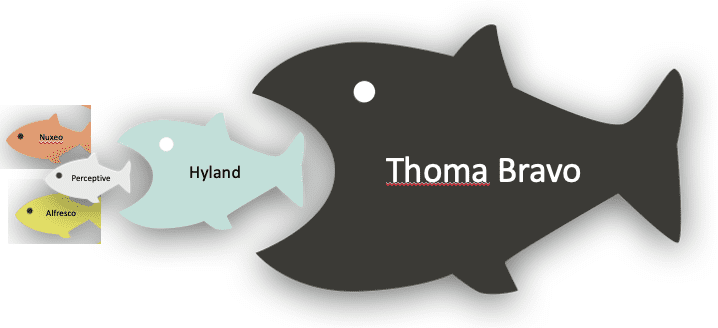

Hyland – This Cleveland, Ohio ECM stalwarth has turned into a shell company for Thoma Bravo. As outlined in our recent BLOG titled “Hyland as the new content super-power….OR ARE THEY? How private equity is killing content management” what is happening here is a financial organization acquiring firms, saddling the Hyland company with the debts of the acquisition and ‘shareholder dividends’ are extracted through additional debts and employees are laid off — AND no real cohesive to a strategy or WHY is being shared. Score: Very Negative

Hyland – This Cleveland, Ohio ECM stalwarth has turned into a shell company for Thoma Bravo. As outlined in our recent BLOG titled “Hyland as the new content super-power….OR ARE THEY? How private equity is killing content management” what is happening here is a financial organization acquiring firms, saddling the Hyland company with the debts of the acquisition and ‘shareholder dividends’ are extracted through additional debts and employees are laid off — AND no real cohesive to a strategy or WHY is being shared. Score: Very Negative

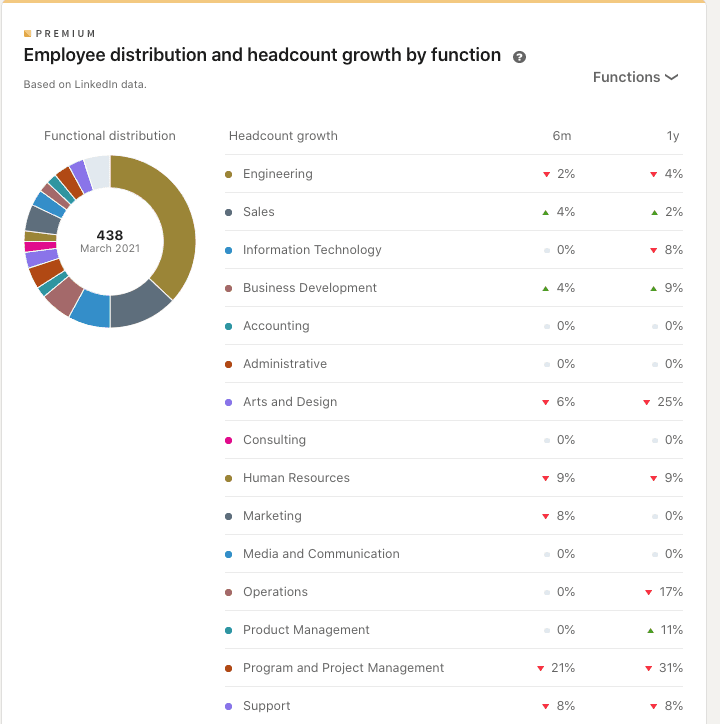

Laserfiche – In context to the market, Laserfiche looks stable and progressive for this Long Beach, CA based organization. But once you look into them further, they also lack innovation, investment and direction. Linkedin shows them shrinking the headcount across the board – but especially in customer centric areas like support are telling. Add to the concerns in that Gartner states they are “overly dependent on partners” to sell, service and maintain customers and this disintermediated relationship keeps them from growing. Score: Neutral

Laserfiche – In context to the market, Laserfiche looks stable and progressive for this Long Beach, CA based organization. But once you look into them further, they also lack innovation, investment and direction. Linkedin shows them shrinking the headcount across the board – but especially in customer centric areas like support are telling. Add to the concerns in that Gartner states they are “overly dependent on partners” to sell, service and maintain customers and this disintermediated relationship keeps them from growing. Score: Neutral

Other major cloud players (Google and AWS) – Neither are directly scored by Gartner or show any focus in this area. That is too bad. They have the pieces and parts to get into the content game, but because of their size do not consider this a strategic necessity. AODocs does sit exclusively on the Google platform, but lack scale, leadership and desire to take on the larger workloads that are indicative of content management expectations. Score: Negative

There are other vendors that could be called out but they would all be – at least – in a neutral-or-less score. They either lack the desire, investment, culture, technical ability or cloud-ability to mention. This also puts them into a position to be acquired by OpenText (as a place where software goes to linger) or stay in their geographical, industrial or geographical comfort-zone.

What is actually making the content space interesting

Areas of the content world that are interesting are in automations. Capture-centric to be exact – from the likes of Abbyy, Hyperscience, within the like of AWS/Google/Azure and the like. The value of the repository is not actually that large – it is about automations around capture and that almighty desire for ‘straight through processing’ where no human has to participate is the new ‘nirvana’. Where 2021 is interesting is less about the content store and more around cloud-based content automation.

Bibliography:

- Gartner Magic Quadrant chart: <HERE>

- Linkedin company profile and insights

- Glassdoor scores and opinions from employees and x-employees: <HERE>

- Gartner Peer Insights: <HERE>

InfoDNA Solutions is here to help organizations to assess where they are today, identify the business imperatives and find how to make they journey to better empower document centric work a reality. Learn more at www.infodnasolutions.com.