Reuters broke the story around “Box explores sale amid pressure from Starboard“. The telling portion of the article was “While Box has benefited from this trend, it has struggled to fully capitalize on it, as some of its services and products are offered by competitors such as Microsoft Corp either for free or at a lower cost.”.

Aaron Levie, founder and CEO, strove the create peer relationships and partnerships to show corporate clients BOX could be that trusted repository for the corporate unstructured data. But missteps were abound:

- IBM reseller agreement: IBM has been reselling BOX for over 4 years with little to show for it. The IBM content group were never for this agreement and the agree has brought little value to clients, IBM or BOX. Yet the IBM CEO has consistently shown up at the BOX WORKS conference to show they mutual support.

Workflow: 4 years ago BOX worked with IBM to create enterprise workflow over the top of BOX and they called it ‘BOX Relay’. It was a flop. Then BOX went and bought a small workflow company in 2018 and turned that into ‘BOX Relay’.

Workflow: 4 years ago BOX worked with IBM to create enterprise workflow over the top of BOX and they called it ‘BOX Relay’. It was a flop. Then BOX went and bought a small workflow company in 2018 and turned that into ‘BOX Relay’.- Cost: as previously mentioned Microsoft in the 365 license to corporation comes all the OneDrive and SharePoint they would never need. Add to this all the ala-carte ways BOX add to their costing model and the economics were not in their favor. You get BOX – but if you want ‘Zones’, ‘Shield’, ‘Governance’ and ‘Platform’ it becomes complicated and expensive quickly. All the while Microsoft through in ‘good enough’ alternatives to this in with the 365 subscription.

- No patience for strategic selling – while they have to defend their install base against Microsoft: The quick sale of seats of BOX has been the primary motivator in their selling motions. The idea of marketing and selling a bigger story has been problematic for BOX because of their need for the more immediate revenue. When they are in a position to be more strategic, it tends to be because clients want to leave BOX so their effort is ‘defensive’.

- Solutions on top of BOX: The BOX ecosystem of turn-key solutions never materialized. With that other AppExchanges and Marketplaces have not necessarily created that repeatable content platform play for them. Consider Salesforce App as an outlet as SFDC does not offer a content answer natively – this should be HUGE for BOX. Reviews are old and not that positive.

- BOX decides to follow their competition with an e-signature acquisition: As a stop gap, BOX acquired SignRequest to add digital signature to documents within the BOX platform. Much like Dropbox buying HelloSign, this is away to add value that is also different to Microsoft for them.

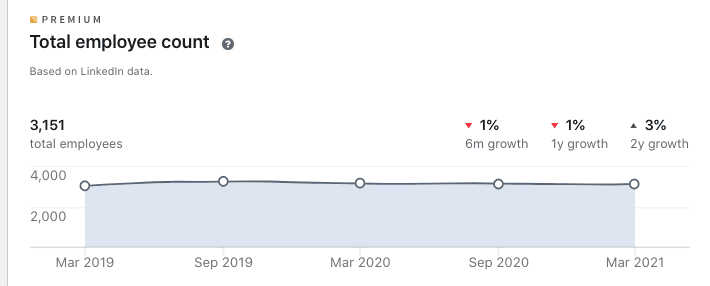

- Their executive ranks are turning over and overall employee base has shrunk. Losing Jeetu Patel to Cisco is an example of a strategic thinking who left BOX. Add to that their overall employee count has been steadily shrinking. As per Linkin Analytics, this trend is not new:

BOX Potential is there – but who will buy them will decide that fate.

InfoDNA Solutions considers a few obvious suitors for BOX with different outcomes for the technology and clients:

- Legacy IBM – If OpenText or IBM buy it that will be another nail in the coffin for BOX. Neither can compete with Microsoft or spell ‘cloud’.

- Cloud – If Salesforce or Servicenow buys them, they would give them a cloud-native tailwind and drive further innovation, growth and most like cost increases.

- Private Equity – If they are taken private by a PE firm, that will just hide the reality of the dysfunction because they will not be required to share data like a public firm. Depending on the firm, this could give them some flexibility, but the overall view is more debt, cost-takeout, unhappy employees and market share reduction.

InfoDNA Solutions is here to help drive an end-to-end assessment of a content strategy and part of that is vendor selection along the way. Learn more from www.infodnasolutions.com