Does it make investment in a technology company to help it grow – generally YES. But with that investment the founders give up control. This has been happening to Hyland since being acquired by Thoma Bravo in 2007. Since that time we see where Thoma Bravo has:

- Acquired Lexmark Enterprise Software in 2017. This included Kofax, Readsoft and Perceptive and spun out Kofax/Readsoft into a company and pushed Perceptive into Hyland.

- April 2018, Bravo acquired OneContent from Allscripts to add into the Hyland portfolio.

- In 2018, Hyland ‘taking on $450 million debt to pay shareholder dividend‘ adding cash burdens on the organization

- Hyland – with funding from Bravo – acquires Alfresco to add to their repository portfolio in fall 2020.

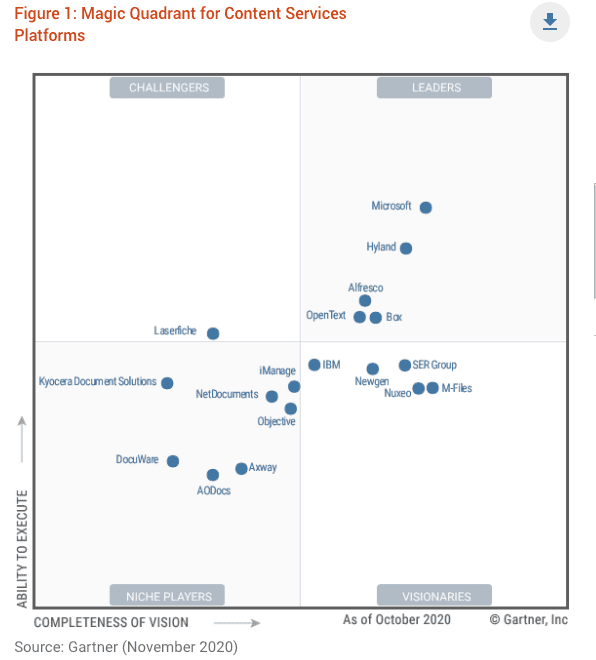

This ‘growth through acquisition’ strategy has caused ripples in the content space – mostly in areas like healthcare, insurance and government customers of these organizations. Using the latest Gartner Content Services Magic Quadrant as a reference point, they state their CAUTIONS around Hyland to include:

This ‘growth through acquisition’ strategy has caused ripples in the content space – mostly in areas like healthcare, insurance and government customers of these organizations. Using the latest Gartner Content Services Magic Quadrant as a reference point, they state their CAUTIONS around Hyland to include:

Cautions

Developing cloud presence: Hyland’s cloud offering trails some other Leaders in this market. Today, there are no SaaS or PaaS self-service provisioning options for OnBase, which may increase hosting and management costs. The first iteration of the next-generation multitenant SaaS platform is scheduled for release in the final quarter of 2020; however, its initial release is limited to a single capture-based application. Hyland has other multitenant SaaS products in the portfolio.Commercial cost and complexity: Hyland’s platform is among the most expensive in the content services market. Its proposals often contain a complex bill of materials and licensing metrics that make it difficult to analyze overall value. Hyland has made improvements to simplify this and provide value transparency with licensing bundles. This pricing was released in 2020 and is early in its rollout. It does not yet make up the majority of Hyland proposals that are reviewed by Gartner.

Growing geographical presence: Compared to other established Leaders in this Magic Quadrant, Hyland’s presence is limited in territories outside of North America. The majority of its implementation partners and a majority of its customers are based in North America. Hyland’s EMEA customer base has grown, primarily due to acquisition, and this presence will increase as the Alfresco acquisition completes. Hyand is continuing to grow its international partner footprint and is increasingly working with global system integrators. However, clients outside of North America need to ensure that they have access to the right level of skills and resources for any project undertaken.

Finally in the last 30 days the company laid off 11% of their employees across the board. From this article,

Finally in the last 30 days the company laid off 11% of their employees across the board. From this article,

The mass axing “came out of left field,” according to a former employee, and was communicated to unsuspecting remote workers in a pre-recorded Zoom message Wednesday morning.

The layoffs reduce the department by an estimated 1/8th, with software developers, quality assurance specialists and testing engineers all unceremoniously getting the boot.

RESULTS:

There is a ‘playbook’ for private equity firms like Thoma Bravos to acquire, cut costs, load up with debt and where a low-cost ‘buy’ can be added to the mix to ‘acquire marketshare’ it takes place. All the while employees and customers become more confused and disheartened.

InfoDNA Solutions is here to bring alternatives to clients. Offering a quick and complete means of migrating to an alternative is now possible no matter which repository you are running under the Hyland ownership. Learn more at www.infodnasolutions.com