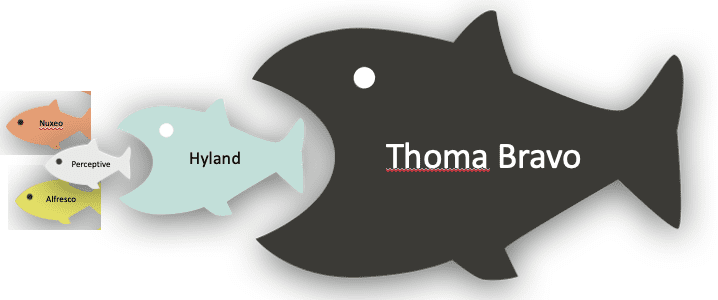

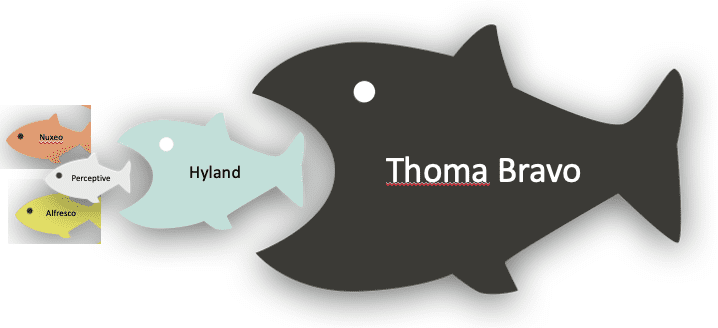

In the last 6 months, the private equity firm of Thoma Bravos (TB) has funded the acquisitions of Alfresco and Nuxeo to place inside their Hyland Software organization. This is also after this same action happen a few years back with the Perception technologies that are now disappearing inside Hyland after TB purchased the Lexmark Software group.

From immediate reactions it is a ‘wait and see’. Fundamental questions persist:

From immediate reactions it is a ‘wait and see’. Fundamental questions persist:

- Why so many repositories now under one owner? This is starting to look as crazy as OpenText.

- Is this a way to limp together a better go-forward strategy through acquisition that was not possible organically?

- This is still a people business – what happens to all the employees as this begins to gel? They recently laid off 11% of their total employee base – and now will need to do more. Consider the latest ‘Glassdoor‘ over time in how employees/x-employees feel about the company. It is a generally negative slope.

The most damning quote from an employee includes:

At 10 AM on a Tuesday 140 employees were pulled into a meeting where a pre-recorded message played that told us we were all being let go. The remaining employees were told that they were going to hire 300 people in Poland and India. I was a high performer, my team lead had nothing but good things to say about my performance. They weren’t even consulted. Neither was their boss. Completely blindsided everyone who wasn’t C-level. The software is antiquated. The pay is far below industry averages. The right hand has no idea what the left hand is doing. Never had any transparency as to what I would be working on further than a few weeks in advance. Benefits and perks constantly being stripped away with nothing to replace them. No cost of living raises. Performance raises are laughable. But they have a slide in lobby, so woo. Promotions are held over your head forever. Advancement is non-existent.

Considering this is – in fact- a private equity driven play by TB using Hyland as their front, I think we can all feel the motive is short-term profit based. It is also a way to leverage intangible assets to borrow against to drive further acquisitions. In the 20th century this was called ‘junk bonds’. Consider the latest report around how the recent acquisitions were funded through debt instruments with a Caa1 rating. In this release, the most telling sentence is “Under ownership of financial sponsors Thoma Bravo, Hyland is expected to maintain an aggressive financial strategy that favors shareholders as evidenced by the company’s numerous debt-funded acquisitions and shareholder distributions“. Nothing about that statement discusses innovation, customers or employees.

InfoDNA Solutions Recommendation

If you are a customer using Hyland, Perceptive, Alfresco or Nuxeo technologies contact us to help you best evaluate your way forward as all this financial maneuvering will undoubtedly result in a convoluted product strategy and high costs. For organization discussing a way-forward in their content and document strategy, let InfoDNA bring their business and technical abilities to drive success. With the TOPLA tool, the ability to assess and analyze all the unstructured documents in an organization will give immediate perspective and prepare in what to move to next in content services.